december child tax credit amount

You wont get a payment in January but you can expect more enhanced child tax credit money to arrive this year. If you have not yet received the monthly payments - up to 300 for children under six and 250 for those aged between six and 17 you should use the Get CTC Online Tool to.

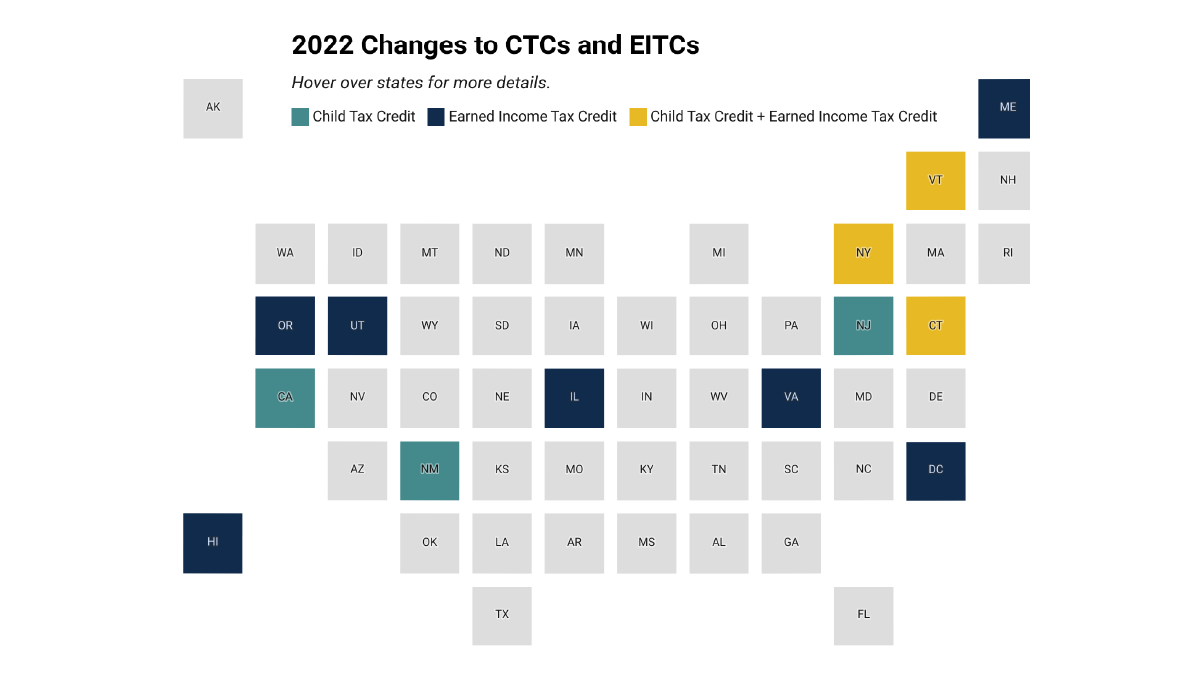

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years.

. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax. For both age groups the rest.

A single taxpayer with 2 qualifying children and modified adjusted gross income MAGI of 80000 can claim a Child Tax Credit of 1750. Since the child tax. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

Up to 3000 for each qualifying. Starting in 2021 the taxes you file in 2022 the plan increases the Child Tax Credit from 2000 to. A childs age determines the amount.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Up to 3600 for each qualifying child under 6.

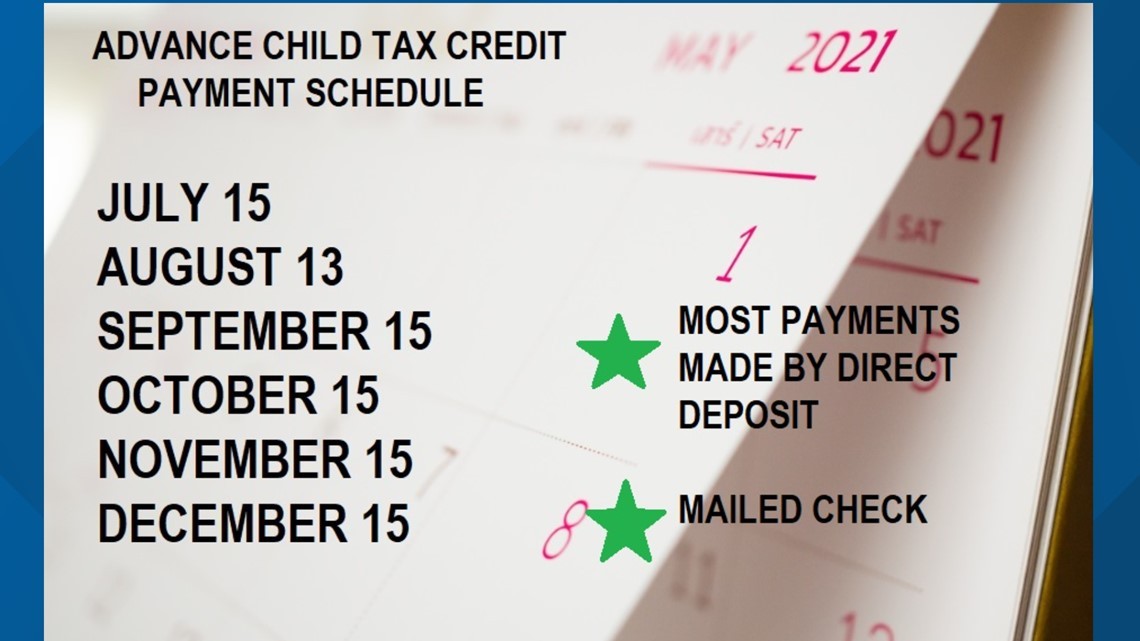

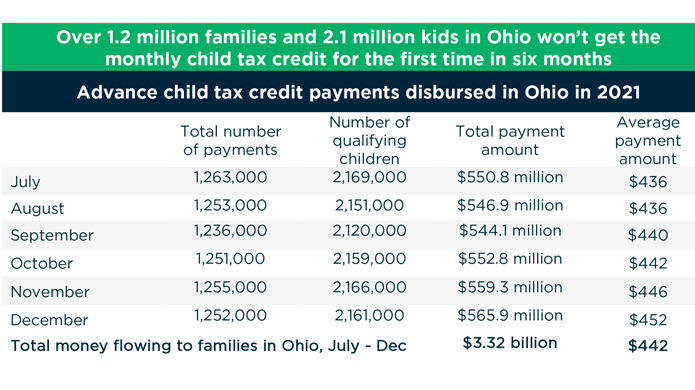

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Below we lay out a few different scenarios and explain how much your family could be getting with the payments set to go out on December 15. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in.

Have been a US. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The IRS bases your childs eligibility on their age on Dec.

For 2021 eligible parents or guardians. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. December child tax credit amount Tuesday October 11 2022 Edit.

However the deadline to apply for the child tax credit payment passed on November. Here are some numbers to know before claiming the child tax credit or the credit for other dependents. The IRS pre-paid half the total credit amount in monthly payments from.

Number of Children x 2000. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The maximum child tax credit amount will decrease in 2022. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. The maximum amount of the child tax credit per qualifying child.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

Child Tax Credit 2021 8 Things You Need To Know District Capital

How To Get The Child Tax Credit Massachusetts Jobs With Justice

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week The Us Sun

Child Tax Credit 2022 December Payment

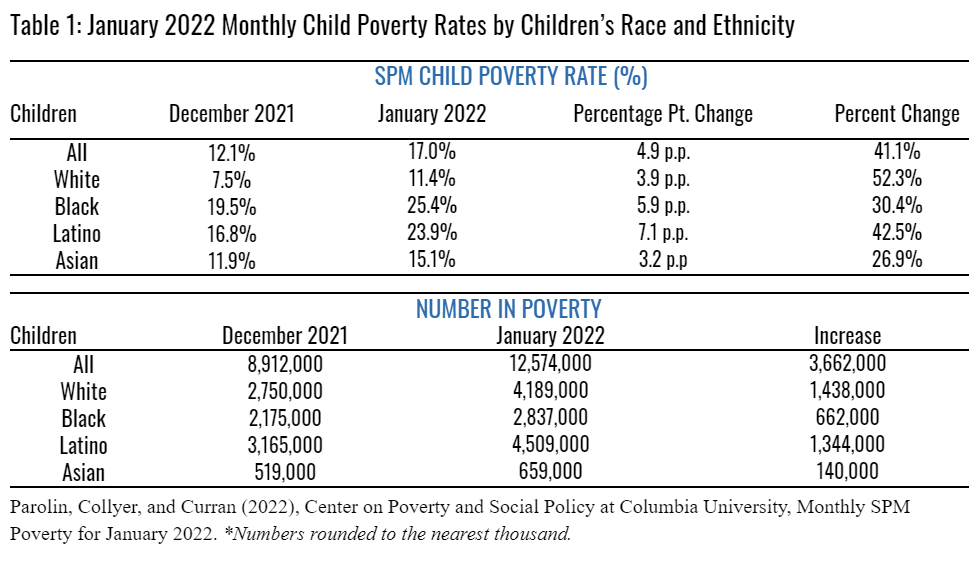

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

The 2021 Child Tax Credit John Hancock Investment Mgmt

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit Why December Payment Could Possibly Be The Last

Krs And Associates You May Have Questions About The Upcoming Changes To The Child Tax Credit The Credit Amounts Have Been Expanded And Payments Will Start In July And Go Through

What To Know About The First Advance Child Tax Credit Payment

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

All You Need To Know About The New Child Tax Credit Change

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Stimulus Update Last Child Tax Credit Payment In December Important Deadline Ahead Al Com

Child Tax Credit December 2021 How To Track Your Payment Marca

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)